Mutual Funds vs FD in India 2026 Both are popular investment options in India. However, they differ significantly. Fixed Deposits are interest-earning investment options. On the other hand, Mutual Funds earn returns by investing in a diversified investment portfolio. The fund invests across stocks, debt instruments, and other assets. Mutual Funds are managed by fund managers. The associated risk, liquidity, returns, and investment duration differ for both FD and MF.

Whenever the topic of Mutual Funds vs FD in India 2026 arises, fixed deposits end up walking away with the favourable vote of confidence. For the longest time, fixed deposits were the only kind of investments that were regarded as safe and dependable.

If you are someone who grew up in India, we can easily assume that you are no stranger to the concept of fixed deposits. Any financial advice pouring in from senior family members probably included fixed deposits as a mandatory investment. Between Mutual Funds vs FD in India 2026, which is a better investment? This seems to be the most common question asked by investors today.

As the financial markets became more sophisticated with time, the investment choices continued to grow exponentially. Today there are countless financial products that cater to various financial needs of the different types of investors. One such investment option is mutual funds.

Mutual Funds vs FD in India 2026: Key Differences

| Particulars | Mutual Fund | Fixed Deposit |

| Returns | Market Linked | Guaranteed |

| Risk | High Risk | No/Low-Risk |

| Investments | Monthly (SIP) or Lumpsum | Lumpsum |

| Expenses | Charges for fund management – Expense Ratio. | No expenses |

| Lock in Period | No | Yes |

| Liquidity | High | Medium |

| Premature Withdrawal | Allowed, with or without exit load | Attracts penalty |

| Taxation | Depends on the type of MF and investment holding period. | As per income tax slab rate. |

| Who Can Invest? | Investors with good understanding of risk | Investors seeking stable and guaranteed returns. |

| Offered By | Asset Management Company | Banks and Financial Institutions |

| Regulated By | SEBI | RBI |

| Impact of interest rate movements | Depends on kind of Mutual Fund | Unaffected, the interest rate is pre-determined |

For some reason, Mutual Funds vs FD in India 2026 are constantly pitted against each other. When people constantly ask which is better, mutual funds or fixed deposits, it isn’t necessarily a fair comparison because these two financial products differ in one major aspect.

One of the biggest differences between Mutual Funds vs FD in India 2026 is that, a mutual fund provides return on the money invested and fixed deposits offers interest payments on the money deposited. As you can see, there is a major difference between investing money (investing being the keyword here) and depositing a lumpsum in one go (depositing being the keyword here).

To help you understand better, let’s look at fixed deposit and mutual funds in detail.

What is a Fixed Deposit? Mutual Funds vs FD in India 2026

A fixed deposit is a financial instrument offered by banks, post office, and other NBFCs (Non-Banking Financial Company) which offers the investors a higher rate of interest compared to regular savings or a salary account. Banks use the deposit money as capital for other business operations. One such example is issuing loans at a higher interest rate than the rate they pay to fixed deposit account holders.

To invest in a fixed deposit, you need to have that kind of money (lump sum amount) already available. Typical investors in fixed deposits are the ones who would have already accumulated surplus cash over a period of time. For this reason, fixed deposits are a popular choice of investments for retired individuals and senior citizens. Another category of fixed deposit investors are the ones who would have huge sum coming in from a sale of property or inheritance.

Key Highlights – Mutual Funds vs FD in India 2026

- The principal amount deposited in fixed deposits remains the same. It does not increase in value or grow in any other form.

- The interest rate offered by the banks can change if the bank decides to make any alterations to the interest rate.

- With fixed deposits, you know exactly what your fixed deposit return is. It is a very predictable financial product.

How Does a Fixed Deposit Work? Mutual Funds vs FD in India 2026

Now that we have learnt the fixed deposit definition. Let us learn more about how a fixed deposit works.

A fixed deposit is a type of an account opened with a bank, where a bank agrees to pay a fixed rate of interest for a particular period of time.

For example, let us assume that you invested a sum of Rs. 10,00,000 for 5 years, with a bank that offers an interest rate of 6% per annum. You would be receiving Rs. 60,000 as interest payment each year for a 5-year period. Based on your financial needs, you can choose to have this interest amount deposited into your account on a monthly basis or once every quarter or once a year.

What is a Mutual Fund? Mutual Funds vs FD in India 2026

A mutual fund is a popular financial product that pools money from multiple investors and invests that money in the equities market. A mutual fund uses the said financial resources to purchase stocks and shares of multiple companies trading on the stock market.

Investing in mutual funds, doesn’t necessarily require any surplus cash and it doesn’t have to be a lump sum investment (unless that is what you want to do). You can invest a small percentage of your monthly income in the form of SIP investments. When your income increases over a period of time, you can also increase the percentage of your SIPs. For this reason, mutual funds are an ideal form of investment option for salaried professionals and individuals with some form of monthly income.

Key Highlights – Mutual Funds vs FD in India 2026

- The principal amount invested in mutual funds has the potential to increase in value. If you stay invested in a mutual fund for a long period of time, your money has the potential to earn better returns as your mutual fund investments are linked to the capital market.

- The longer the tenure of your investment, better the scope of higher returns.

- Unlike fixed deposits, mutual fund returns are not predictable and they are subject to different kinds of market risks. You can roughly estimate how much you can earn but you may not know exactly how much with certainty.

How Does a Mutual Fund Work? Mutual Funds vs FD in India 2026

Now that we have understood the mutual fund definition, let’s learn more about how mutual funds work.

When you invest in a mutual fund, you purchase the mutual fund units (also known as unit shares) to the extent of your investment. There are two possible ways in which you can invest in mutual funds; you can either invest a lump sum amount and see how your investment fares over time or invest in the form of a systematic investment plan (SIP).

SIP refers to investing a predetermined amount on a periodic basis. Each SIP enables you to purchase additional units of the mutual fund. The value of your units held in a mutual fund is determined by the fund’s Net Asset Value (NAV)

An integral part of understanding how mutual funds work is to learn how you earn from mutual fund investments. If you opt for dividend payments, a mutual fund will payout its annual earnings as dividend payments. If you opt for reinvestment of your annual earnings back into the mutual fund, you will have the benefit of capital gain. Capital gain refers to the increase in the value of your asset, it essentially means that your asset is worth more than what you paid for it. Money Insight Hub

Mutual Funds vs FD in India 2026 : Which is a Better Investment?

In addition to what is discussed above, many investors always wonder which has a better presence in India, mutual funds or fixed deposits?Traditionally, as we have mentioned earlier, fixed deposits have always been popular because the investors consider fixed deposits safe and risk-free. But as mutual funds started gaining popularity, and investors started seeing better returns, mutual funds are beginning to give tough competition to fixed deposits.

But, if you are evaluating your options and deciding between an investment in mutual funds versus fixed deposits specifically for you, the answer completely depends on your income, your monthly expenses, and your financial goals. Before you decide where and how you would like to go about investing, you need to have a clear idea about these aspects.

Now, let us learn more about how Mutual Funds vs FD in India 2026 differ on certain key investment parameters.

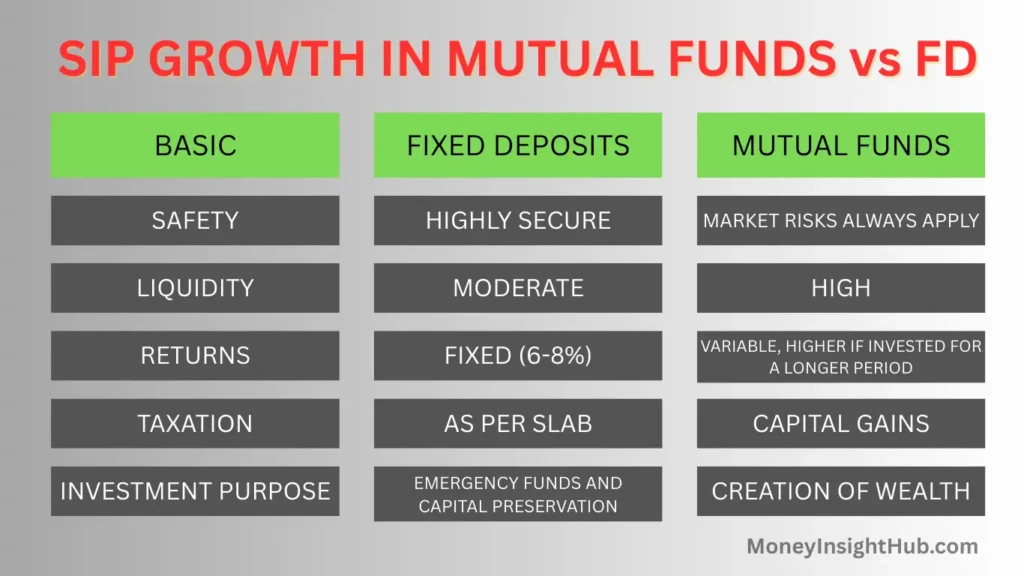

Key Financial Parameters Mutual Funds vs FD in India 2026

Returns

Equity Mutual fund returns completely depend on the performance of the stock market. If the stock market continues to perform well, mutual funds offer returns accordingly. Fixed income based mutual funds tend to be more like fixed deposits in terms of their return profile. On average, a long-term mutual fund return has been around 12% looking at periods of over 5-6 years and a mid and short-term mutual fund return (debt funds) has been in the range of 6%-7%.

As mentioned earlier, fixed deposit returns are predetermined. Fixed deposit returns are guaranteed payments throughout the tenure of your investment. The average rate of return on fixed deposits has been in the range of 5% to 7%. Fixed deposit return depends on the bank you choose to open your fixed deposit account with.

Risk – Mutual Funds vs FD in India 2026

- There is a reason why the phrase, “mutual fund investments are subject to market risks” is constantly floating in the market. That is because equity mutual fund risk is linked to market risk. Mutual fund risk also depends on the type of fund one chooses to invest in.

- Fixed deposit risk is relatively low. The depositor will continue to receive the fixed interest payment. This is because fixed deposits are not affected by market performances. However, a bank can still go bust and your FDs and interest is insured only up to an amount of Rs 5 Lakh.

Growth – Mutual Funds vs FD in India 2026

- As highlighted earlier, equity mutual fund growth is linked to market growth and depends on how the mutual fund performs over a period of time. Your principal investment continues to grow if the market is on an upward trend.

- With fixed deposits, the principal amount deposited remains the same throughout the investment tenure.

Withdrawal – Mutual Funds vs FD in India 2026

- Mutual fund withdrawals are pretty straightforward. If you have invested in an open-ended fund, you can withdraw your investment at any time. With some mutual funds, you may have to stay invested for a minimum of one year. In some cases, you may have to pay an exit load fee of 1%.

- Fixed deposits withdrawals on the other hand incur a penalty fee. Premature withdrawals attract penalty.

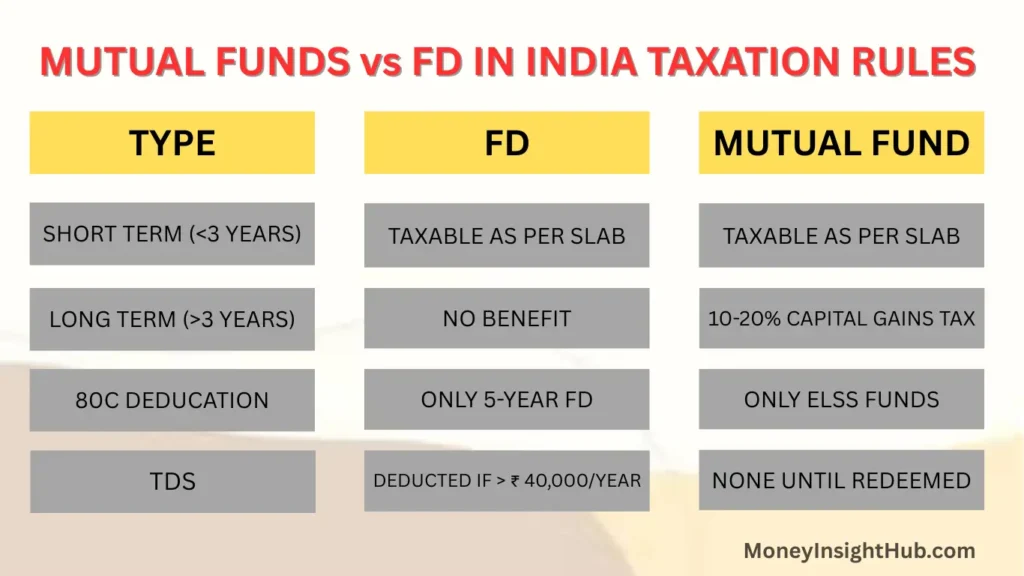

Taxation – Mutual Funds vs FD in India 2026

- Mutual funds taxation is slightly complex to understand. Almost all mutual funds are subject to short-term and long-term capital gains. Short-term capital gains tax (STCG) are taxable at a flat 15%. Whereas long-term capital gains tax (LTCG) are taxable at 10% of the earnings above 1 lakh in case of equity. In the case of debt mutual funds, LTCG are taxable at 20% after indexation. If you want to learn more about how mutual funds are taxed.

- Fixed deposits taxation is in accordance with the income tax slab of the depositor. Fixed deposits are subject to 10% TDS on interest earned over Rs. 5,000 in one financial year Mutual Funds vs FD in India 2026.

Benefits of Mutual Funds vs Fixed Deposit Mutual Funds vs FD in India 2026

Mutual Fund – Mutual Funds vs FD in India 2026

- Your investment is professionally managed by a fund manager so you don’t have to monitor the market yourself.

- Offers better returns (based on whether you choose debt funds or equity based mutual funds) than fixed deposits.

- You can start investing with small amount.

- Offers risk mitigation through diversification.

- Offers better taxation compared to fixed deposits.

- Explore: Benefits of Mutual funds

Fixed Deposit – Mutual Funds vs FD in India 2026

- Comes with very low risk.

- Provides a guaranteed rate of return.

- Convenience of monthly regular payments.

- Secured investment for senior citizen.

- Explore: Why Indians prefer FD

Frequently Asked Questions

1. Which is better in 2026—mutual funds or fixed deposits?

Mutual funds can offer higher returns but come with market risks, while fixed deposits provide stable but lower returns. Your choice depends on your risk tolerance and investment goal.

2. Who should invest in mutual funds?

Mutual funds are ideal for long-term investors, young professionals, and those willing to take some risks for higher growth. If you need safety and fixed returns, FDs are better.

3. Are fixed deposits safer than mutual funds?

Yes, fixed deposits are safer as they guarantee returns and are not affected by market fluctuations. However, their returns may not always beat inflation.

4. How are mutual funds taxed compared to fixed deposits?

FD interest is fully taxable as per your income tax slab. Mutual funds are taxed based on holding period—long-term gains (after 12 months) on equity funds are taxed at 10% beyond ₹1,25,000, while short-term gains are taxed at 20%.

5. Can mutual funds give better returns than fixed deposits?

Yes, mutual funds—especially equity funds—can give higher returns (10%-15%) over the long term, while FDs typically offer 6%-7.5% returns.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.