Introduction

Mutual Funds vs FD in India 2025

Aaj ke samay me jab financial awareness badh rahi hai, log apne paise ko sirf bank me rakhne ke bajaye investment karne par zyada dhyaan de rahe hain.

Sabse popular aur common investment options me Mutual Funds vs FD in India 2025 (FDs) aate hain.

Lekin jab sawal uthta hai — “Mutual Funds vs FD in India 2025?”

toh jawab itna simple nahi hota.

Dono ke apne faayde aur nuksan hain, aur aapke investment goals, risk appetite aur time horizon par depend karta hai ki aapke liye kaunsa sahi hai.

Is article me hum step-by-step samjhenge:

- FD kya hai aur kaise kaam karta hai

- Mutual Fund kya hai

- Dono ke pros & cons

- 2025 ke returns comparison

- Tax aur risk analysis

- Aur akhir me — kis investor ke liye kaunsa best hai

What is a Fixed Deposit (FD)?

Fixed Deposit ya FD ek traditional investment option hai jahan aap apna paisa ek fixed period ke liye deposit karte ho (1–10 saal tak).

Bank aapko ek fixed interest rate deta hai jo market ke uthal-puthal se affect nahi hota.

✅ Advantages of FD

- Guaranteed Returns – Market down ho ya up, aapka interest fix rehta hai.

- Zero Risk – FD me paisa safe hota hai, especially government or reputed banks me.

- Flexible Tenure – Aap 7 days se lekar 10 saal tak FD rakh sakte ho.

- Loan Facility – Aap apne FD ke against loan le sakte ho.

- Senior Citizen Benefits – Senior citizens ko zyada interest rate milta hai (0.5% extra).

❌ Disadvantages of FD

- Low Returns – Average 6%–8% tak return milta hai.

- Inflation Risk – Inflation agar 7% ho aur FD return 6.5%, toh real value ghatti hai.

- Premature Withdrawal Penalty – Time se pehle todne par penalty lagti hai.

- Tax on Interest – Interest income puri tarah taxable hoti hai.

What is a Mutual Fund?

Mutual Fund ek market-linked investment hai jahan investors ka paisa ek pool me jama hota hai aur professional fund managers usse stocks, bonds, aur securities me invest karte hain.

✅ Advantages of Mutual Funds

- High Returns Potential – 10%–18% annual average return (fund type par depend karta hai).

- Diversification – Ek fund me kai companies me investment hoti hai, jisse risk kam hota hai.

- SIP Option – Monthly ₹500 se bhi start kar sakte ho.

- Liquidity – Aap apna paisa anytime withdraw kar sakte ho (except ELSS).

- Tax Benefits – ELSS Mutual Funds me ₹1.5 lakh tak 80C deduction milta hai.

❌ Disadvantages of Mutual Funds

- Market Risk – Returns market ke upar depend karte hain.

- No Guaranteed Returns – Loss bhi ho sakta hai agar market gir gaya.

- Fund Management Fees – Expense ratio (1–2%) lagta hai.

- Emotional Risk – Short-term market down hone par panic selling ho sakti hai.

⚔️ Mutual Funds vs FD: Key Comparison Table

| Feature | Mutual Fund | Fixed Deposit |

|---|---|---|

| Type | Market-linked | Fixed return |

| Risk | Moderate to High | Very Low |

| Average Return (2025) | 10%–18% p.a. | 6%–8% p.a. |

| Liquidity | Easy (except lock-in funds) | Lock-in applies |

| Taxation | Capital gains tax | Interest fully taxable |

| Inflation Protection | Yes | No |

| Minimum Investment | ₹500 SIP | ₹1,000–₹10,000 |

| Ideal Tenure | 3–10 years | 1–5 years |

| Investment Goal | Long-term wealth creation | Safe short-term saving |

“Comparison of Mutual Fund vs FD Returns in 2025.”

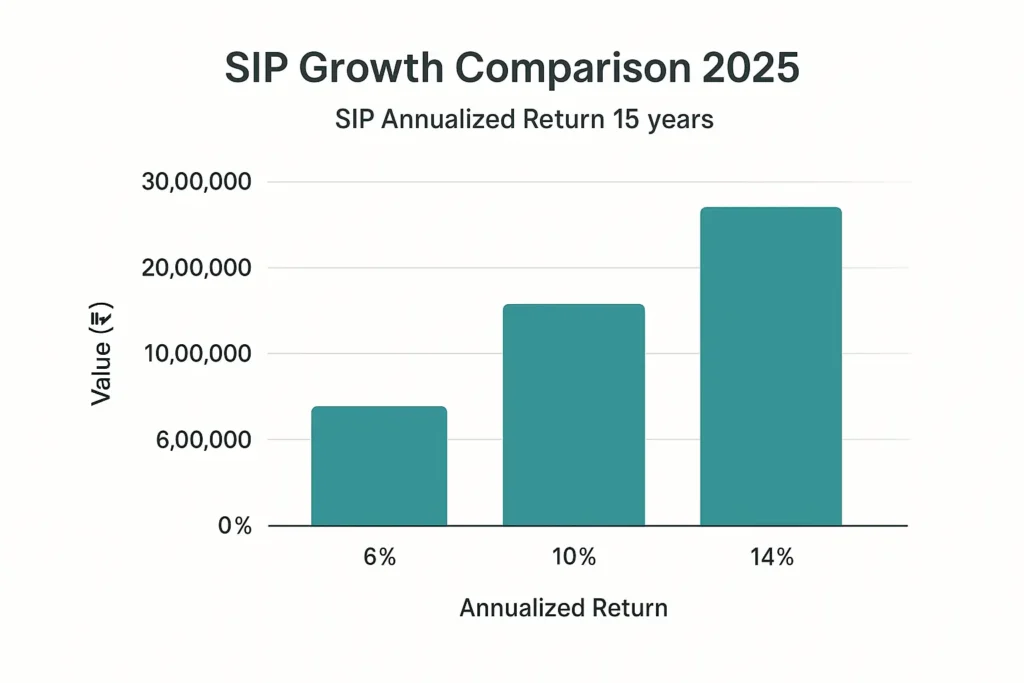

📈 Mutual Fund vs FD Returns (Example Calculation)

Scenario: Mutual Funds vs FD in India 2025

“Let’s see how ₹10,000 SIP grows in Mutual Fund vs FD over 5 years 👇”

You invest ₹1,00,000 for 5 years.

| Option | Return Rate | 5-Year Value | Profit |

|---|---|---|---|

| Fixed Deposit (7%) | 7% p.a. | ₹1,40,255 | ₹40,255 |

| Mutual Fund (12%) | 12% p.a. | ₹1,76,234 | ₹76,234 |

Difference: Mutual Funds vs FD in India 2025

→ Mutual Fund ne ₹36,000 extra return diya same 5 saal me.

Yahi compounding ka magic hai.

🧠 Mutual Funds vs FD in India 2025 Risk vs Reward Analysis

| Factor | FD | Mutual Fund |

|---|---|---|

| Capital Safety | High | Moderate |

| Return Stability | Stable | Fluctuating |

| Inflation Beating | No | Yes |

| Market Dependency | None | High |

| Long-term Growth | Limited | Strong |

👉 Agar aapko safety chahiye to FD.

👉 Agar aapko growth chahiye to Mutual Fund.

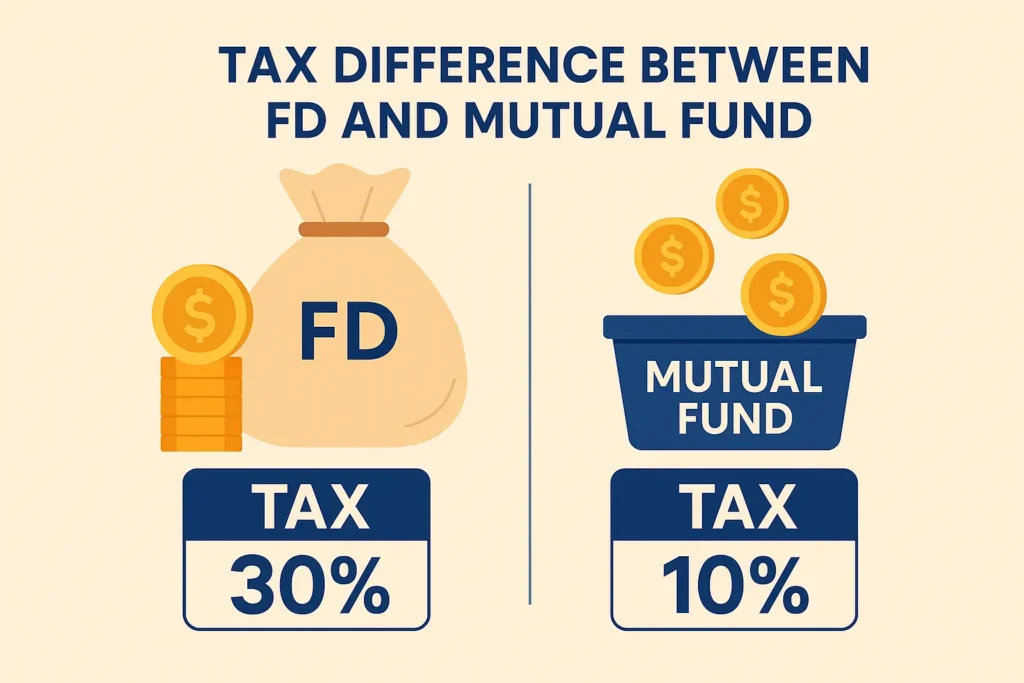

🧮 Mutual Funds vs FD in India 2025 Taxation Rules.

| Type | FD | Mutual Fund |

|---|---|---|

| Short Term (<3 years) | Taxable as per slab | Taxable as per slab |

| Long Term (>3 years) | No benefit | 10–20% capital gains tax |

| 80C Deduction | Only 5-year FD | Only ELSS Funds |

| TDS | Deducted if > ₹40,000/year | None until redeemed |

💡 Tip: Best UPI Apps in India 2025

If you’re in the 30% tax slab, Mutual Fund ELSS is a better tax-saving choice.

Types of Mutual Funds (2025)

| Fund Type | Risk | Returns | Tenure |

|---|---|---|---|

| Equity Funds | High | 12%–18% | 5+ years |

| Debt Funds | Low | 7%–9% | 1–3 years |

| Hybrid Funds | Moderate | 8%–12% | 3–5 years |

| Index Funds | Moderate | 10%–12% | 5+ years |

👉 New investors ke liye Hybrid ya Index Funds best start hote hain.

🕒 Which One to Choose – Mutual Funds vs FD in India 2025?

Choose FD if: Mutual Funds vs FD in India 2025 – Which is Better in 2025?

- Aapko guaranteed, safe returns chahiye

- Short-term (1–3 years) ke liye invest kar rahe ho

- Aap retired ho ya risk avoid karna chahte ho

Choose Mutual Fund if: Mutual Funds vs FD in India 2025 – Which is Better in 2025?

- Aapka goal long-term wealth creation hai

- Aap risk le sakte ho

- Aapko inflation-beating returns chahiye

💡 Balanced Tip: Credit Card vs Debit Card – Konsa Better in 2025?

Apne portfolio ka 70% Mutual Fund me aur 30% FD me rakho —

yeh ek smart balance create karta hai between safety and growth.

🧭 Future of Mutual Funds vs FD in India 2025–2030

| Year | Average FD Rate | Average Mutual Fund Return |

|---|---|---|

| 2020 | 6.0% | 10.5% |

| 2023 | 7.2% | 11.8% |

| 2025 (Est.) | 6.8% | 12.5% |

| 2030 (Projection) | 6.5% | 14%+ |

Mutual Funds ne consistently FD se zyada performance dikhayi hai.

Long-term me compounding effect ke wajah se difference huge hota hai.

📚 Common Myths About Mutual Funds vs FD in India 2025

- ❌ “Mutual Funds are only for experts.”

→ Truth: SIP start karna easy hai, ₹500/month se. - ❌ “FD is always better because it’s safe.”

→ Truth: Inflation ke baad FD real returns low ho jate hain. - ❌ “You can lose all money in Mutual Funds.”

→ Truth: Diversified fund me loss rare hota hai if invested long-term

Real-Life Example Of Mutual Funds vs FD in India 2025

Ramesh aur Suresh dono ne ₹1 lakh invest kiya 10 saal ke liye.

- Ramesh: Chose FD (7%) → ₹1,96,715

- Suresh: Chose Mutual Fund (12%) → ₹3,10,585

- App Bhi Kama Sakte Ho: Top 10 Money Earning Apps in India 2025

👉 Difference: ₹1.13 lakh extra by choosing Mutual Fund.

📌 FAQ – Mutual Funds vs FD in India 2025 (Schema Style)

Q1. Which is safer, FD or Mutual Fund?

FD safer hai kyunki returns guaranteed hote hain, lekin mutual funds long-term me zyada profit dete hain.

Q2. Can I lose money in Mutual Funds?

Short-term me risk hota hai, lekin long-term (>5 years) me compounding se returns positive ho jate hain.

Q3. Which gives better tax benefit?

ELSS Mutual Funds me ₹1.5 lakh tak deduction milta hai (80C). FD me sirf 5-year lock-in FD eligible hai.

Q4. Which is better for 5 years?

Mutual Fund better hai if you can take moderate risk. FD tab hi choose karo agar safety priority hai.

🏁 Final Verdict: Mutual Funds vs FD in India 2025 – Which is Better?

| Investor Type | Best Option |

|---|---|

| Conservative (Risk Averse) | FD |

| Young / Moderate Investor | Mutual Fund SIP |

| Balanced Investor | 70% MF + 30% FD |

| Tax-Saving Goal | ELSS Mutual Fund |

“Learn more about mutual fund regulations on SEBI’s official website.”

👉 Final Words: Best Trading Apps in India 2025

FD ek safe option hai — lekin inflation ke era me growth slow ho jata hai.

Mutual Funds, especially SIPs, long-term me financial freedom la sakte hain.

2025 me smart investor wahi hoga jo risk aur safety dono ka balance banaye.