How to Improve CIBIL Score Fast in India 2025 — if your credit score is low, don’t worry! Your CIBIL score can be fixed faster than you think. A good credit score is the foundation of your financial health. Whether you’re applying for a personal loan, car loan, or premium credit card, your score determines how easily (and cheaply) you’ll get it.

CIBIL (Credit Information Bureau India Limited) is India’s most trusted credit bureau. It maintains records of loans and credit card payments.

Your CIBIL score is a three-digit number ranging from 300 to 900 that shows how trustworthy you are with credit.

| CIBIL Range | Meaning | Loan Approval Chances |

|---|---|---|

| 750 – 900 | Excellent | Very High |

| 700 – 749 | Good | High |

| 650 – 699 | Fair | Moderate |

| 550 – 649 | Poor | Low |

| Below 550 | Very Poor | Very Low |

💡 Tip: Most banks prefer a score above 750 for instant approval and lower interest rates.

- Above 750 = Excellent (easy loan approval)

- 650–749 = Average (higher interest rates)

- Below 650 = Risky borrower

A good credit score is the foundation of your financial health. Whether you’re applying for a personal loan, a car loan, or a premium credit card, your CIBIL score determines how easily (and cheaply) you’ll get it.

Top 10 Money Earning Apps in India 2025

But if your score is low, don’t panic — it can be fixed faster than you think.

In this guide, you’ll learn everything about How to Improve CIBIL Score Fast in India 2025, with real examples, tips, and tools.

When you apply for a loan, credit card, or EMI plan, banks check your CIBIL score before saying “yes.”

A good CIBIL score can:

✅ Help you get instant personal loans

✅ Unlock premium credit cards

✅ Lower your interest rate

✅ Increase your credit limit

Why Your CIBIL Score Is Low

Before fixing, understand why it dropped:

| Reason | Description |

|---|---|

| Missed EMI or credit card payments | Even one late payment can drop 50–80 points |

| High credit usage | Using more than 30–40% of your credit limit signals risk |

| Too many loan applications | Each “hard inquiry” reduces score slightly |

| Closing old credit cards | Reduces average credit age |

| No credit history | No track record = no trust from lenders |

🚫 Common Reasons for a Low CIBIL Score

How to Improve CIBIL Score Fast in India 2025 Before you start improving, it’s important to understand why your score dropped.

1. Missed or Delayed Payments

Even one late payment can reduce your score by 50–80 points.

2. High Credit Utilization

Using more than 30–40 % of your credit limit signals overspending.

3. Too Many Loan Applications

Every new credit application creates a hard inquiry, which temporarily lowers your score.

4. Closing Old Credit Cards

Old accounts add to your credit age — closing them shortens your history.

5. No Credit History

If you’ve never taken credit before, lenders have no data to judge your reliability.

- “If you want to know How to Improve CIBIL Score Fast in India 2025, start by paying EMIs and credit card dues on time.”

- “Maintaining a low credit utilization ratio is one of the easiest ways How to Improve CIBIL Score Fast in India 2025.”

- “Regularly checking your credit report helps in identifying errors that may hurt your score — a crucial step in How to Improve CIBIL Score Fast in India 2025.”

⚡ How to Improve CIBIL Score Fast — Step-by-Step

1️⃣ Pay All EMIs and Credit Card Dues on Time

Your payment history contributes 35 % to your CIBIL score.

Action Plan

- Pay before the due date

- Automate EMI payments through ECS/UPI

- Always pay more than the minimum due indianexpress

Tools:

Apps like CRED, Paytm, or Google Pay send reminders and reward timely payments.

2️⃣ Keep Credit Utilization Under 30 %

If your card limit is ₹1 lakh, keep spending under ₹30 000 per month.

Why it matters:

High utilization shows dependency on credit → increases risk.

Pro Tips:

- Request a limit increase (to reduce utilization %)

- Split spending across multiple cards

- Pay mid-cycle if you spend more early in the month

3️⃣ Avoid Applying for Multiple Loans Simultaneously

Every time you apply for credit, banks check your CIBIL report. Too many inquiries in a short time = desperation signal.

Better Option:

Compare loan offers online first (soft inquiries) on platforms like:

- BankBazaar

- PaisaBazaar

- OneScore

Then apply for one final loan.

4️⃣ Keep a Healthy Mix of Credit Types

Having both secured (home, car, gold loan) and unsecured (credit card, personal loan) credit builds a strong profile.

| Type | Example | Benefit |

|---|---|---|

| Secured | Home Loan, Car Loan | Long-term stability |

| Unsecured | Credit Card, Personal Loan | Shows repayment discipline |

5️⃣ Don’t Close Old Credit Cards

Older cards increase your average credit age, which improves your score.

Instead of closing, make a small purchase every 2–3 months and pay it off. Standard Chartered Bank,

6️⃣ Regularly Check Your CIBIL Report

Visit www.cibil.com for a free report every 12 months.

How to Improve CIBIL Score Fast in India 2025 Look for:

- Wrong loan entries

- Late payments marked incorrectly

- Duplicate or unknown accounts

If you find errors, file a dispute directly on CIBIL — they must respond within 30 days.

7️⃣ Use a Secured Credit Card or Credit Builder Loan

If your score is low or you’re new to credit, start small:

- SBICard Unnati (against ₹25 000 FD)

- Axis InstaEasy or ICICI Instant Card

- Best Credit Cards in India for Cashback 2025

- OneScore Credit Line

Timely repayment of these accounts rebuilds trust with lenders.

8️⃣ Maintain Long-Term Credit Behavior

Improving your score is not a one-month trick; it’s a habit.

How to Improve CIBIL Score Fast in India 2025 Checklist:

✅ Keep utilization < 30 %

✅ Pay before due date

✅ Review CIBIL every quarter

✅ Avoid frequent credit applications

📱 Best Apps to Check and Improve Your CIBIL Score

| App | Key Features | Pros |

|---|---|---|

| CRED | Free CIBIL check, rewards for timely payments | Fun & gamified |

| OneScore | Real-time score updates, no spam | Safe & private |

| Paytm | CIBIL & Experian check, bill reminders | Easy for beginners |

| BankBazaar | Insights & recommendations | Good analytics |

| Experian India | Alternative credit score | Good for verification |

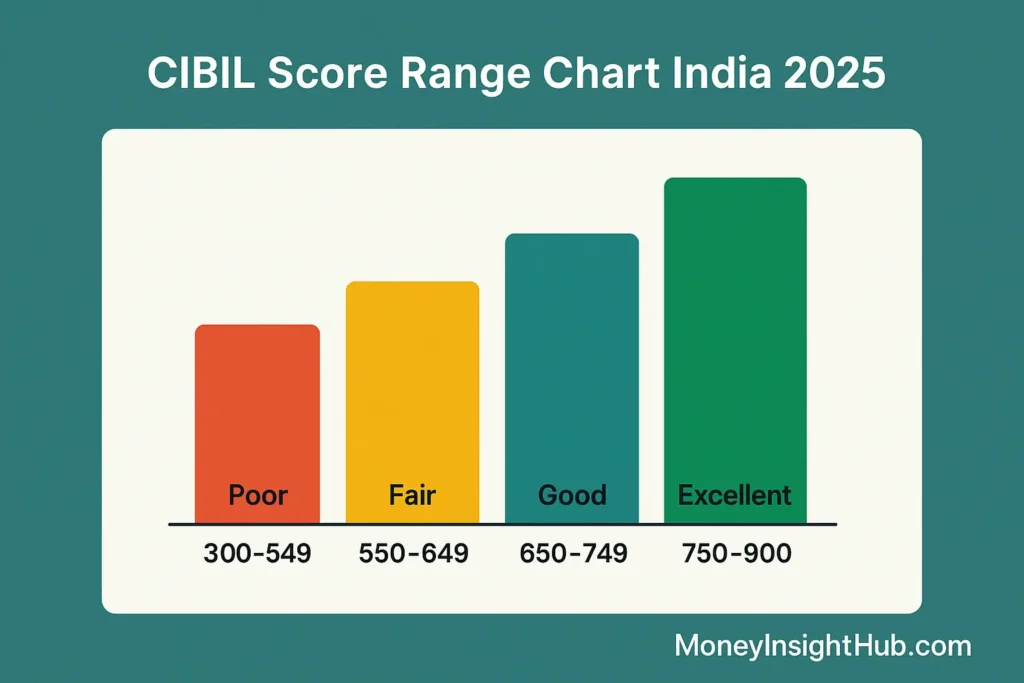

📊 CIBIL Score Range Chart India 2025

| Score Range | Category | Impact |

|---|---|---|

| 750 – 900 | Excellent | Best interest rates |

| 700 – 749 | Good | Eligible for most credit |

| 650 – 699 | Fair | Limited approvals |

| 550 – 649 | Poor | High-interest loans only |

| Below 550 | Very Poor | Rejections likely |

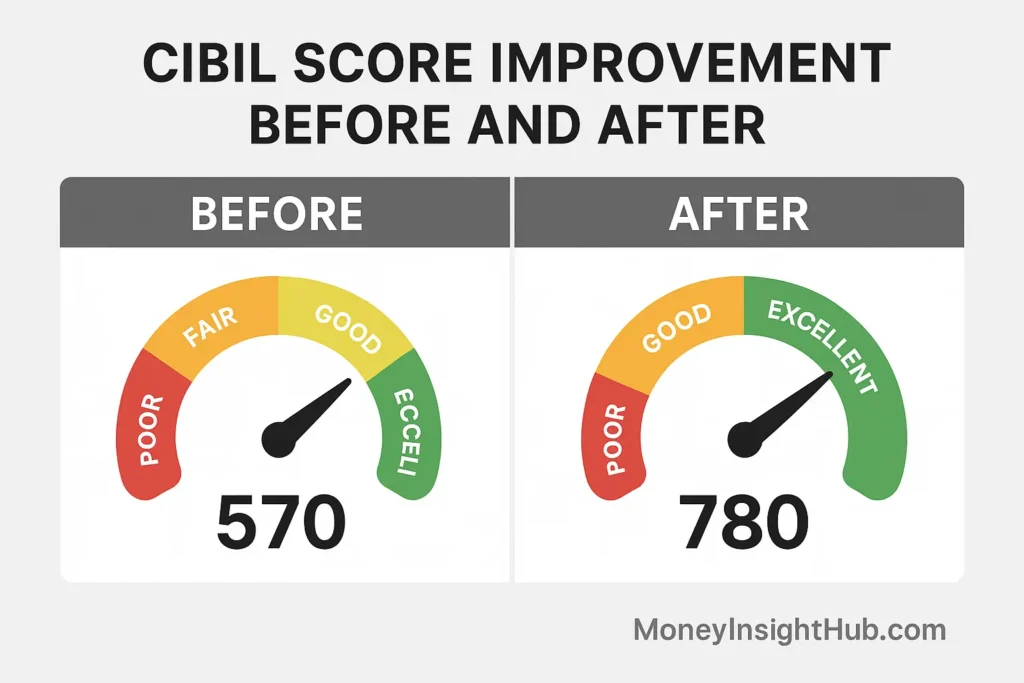

🧮 Real-Life Example: How Riya Improved Her Score

Riya, a marketing professional, had a CIBIL score of 600 after missing three EMIs.

Steps she took:

- Cleared all pending dues.

- Reduced card spending to 25 % of her limit.

- Used CRED to track bills.

- Didn’t apply for new loans for 6 months.

📈 Result: Her score rose to 760 within 5 months!

She got a car loan at a lower interest rate and a higher credit card limit.

🧠 Common Myths About CIBIL Score

| Myth | Fact |

|---|---|

| Checking my own score lowers it | ❌ It doesn’t affect your score |

| Paying off all loans instantly boosts score | ❌ Takes 2–3 months to reflect |

| Closing cards improves score | ❌ It reduces credit age |

| No credit = best score | ❌ No data means no trust |

Expert Tips to Boost Your Score Faster

- Pay before the due date (not on it)

- Keep only 2–3 active credit cards

- Use auto-pay for EMIs

- Maintain one old credit line for 5+ years

- Avoid “Buy Now Pay Later” traps

🕒 Timeline: How Long Does It Take?

| Duration | Expected Improvement |

|---|---|

| 1 Month | +20 to 40 points |

| 3 Months | +60 to 100 points |

| 6 Months | +120 to 180 points |

| 12 Months | +200 points + |

Patience pays — consistent good behavior compounds results.

🏁 Conclusion

Your CIBIL score is not just a number — it’s your financial passport.

With a strong score, you can enjoy:

✅ Instant loan approvals

✅ Lower interest rates

✅ Premium credit cards

✅ Higher financial trust

Mutual Funds vs FD – Which is Better?

Follow these key rules:

- Pay bills on time

- Keep card usage < 30 %

- Review your report quarterly

- Avoid unnecessary credit

By following these steps, anyone can understand How to Improve CIBIL Score Fast in India 2025 and achieve a healthy credit profile within a few months.

Stick to this for 3–6 months and watch your CIBIL score jump 100–150 points! 🚀