🏦 Introduction — Why Fixed Deposits Still Rule in 2025

Fixed Deposit (FD) — Best Fixed Deposit Rates in India 2025 a term every Indian household trusts. Despite the growing craze for mutual funds, stock trading, and crypto, FDs continue to dominate middle-class and senior citizen portfolios Compare FD with other options like Mutual Funds.

Why? Because FDs provide what every investor wants — guaranteed returns and zero risk.

In 2025, FD rates have risen again as RBI repo rate stabilizes around 6.50%, and banks compete aggressively for fresh deposits. That means — you can now earn up to 9% safely, depending on your bank Check official RBI interest rate updates here.

This article will guide you through: Best Fixed Deposit Rates in India 2025

- ✅ Latest FD rates of all top banks

- 🧓 Senior citizen special schemes

- 💸 Tax benefits & best tenure tips

- 🧠 Expert strategies for maximum profit

- 📈 Real comparisons with mutual funds

🔍 What Is a Fixed Deposit (FD)?

A Fixed Deposit (FD) is a savings instrument where you deposit a lump sum amount with a bank or NBFC for a fixed tenure and earn a fixed interest rate.

🔹 Key Highlights:

- Guaranteed returns — unaffected by market ups & downs

- Flexible tenure: from 7 days to 10 years

- Premature withdrawal possible (with small penalty)

- Quarterly or annual payouts available

- Safety: Insured up to ₹5 lakh by DICGC

FDs are the best fit for low-risk investors, retirees, and anyone seeking capital protection + assured income.

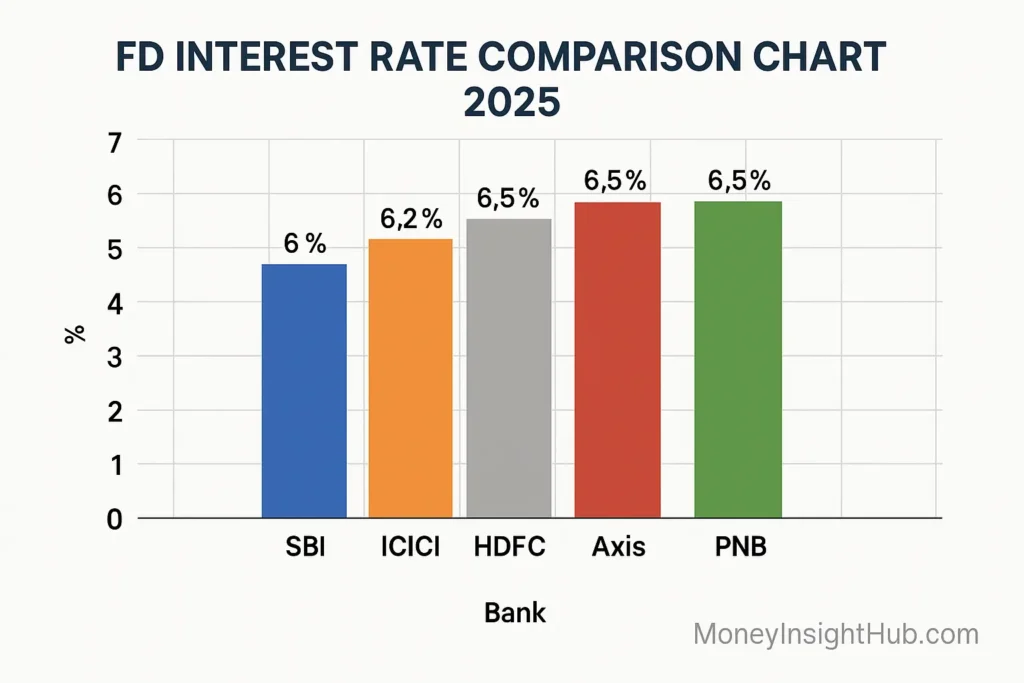

📊 Top 10 Banks Offering the Best FD Rates in India (2025)

| Bank Name | Interest Rate (General) | Senior Citizen Rate | Tenure Range |

|---|---|---|---|

| State Bank of India (SBI) | 6.80% | 7.30% | 7 days – 10 years |

| HDFC Bank | 7.10% | 7.60% | 7 days – 10 years |

| ICICI Bank | 7.05% | 7.55% | 7 days – 10 years |

| Axis Bank | 7.10% | 7.60% | 7 days – 10 years |

| Kotak Mahindra Bank | 7.15% | 7.65% | 7 days – 7 years |

| Canara Bank | 7.25% | 7.75% | 7 days – 10 years |

| Punjab National Bank (PNB) | 7.30% | 7.80% | 7 days – 10 years |

| IDFC FIRST Bank | 7.90% | 8.40% | 7 days – 5 years |

| RBL Bank | 8.00% | 8.50% | 7 days – 10 years |

| Yes Bank | 8.10% | 8.60% | 7 days – 10 years |

💡 Note: Private banks like RBL and small finance banks offer the highest returns, while SBI and HDFC remain safest for conservative investors.

🏦 Small Finance Banks Offering Highest FD Rates (2025)

| Bank Name | General Rate | Senior Citizen Rate | Best Tenure |

|---|---|---|---|

| AU Small Finance Bank | 8.25% | 8.75% | 3 years |

| Equitas SFB | 8.50% | 9.00% | 2 years |

| Ujjivan SFB | 8.75% | 9.25% | 2 years |

| Fincare SFB | 8.60% | 9.10% | 2 years |

| Suryoday SFB | 8.55% | 9.05% | 2 years |

⚠️ Caution: While returns are high, these banks are smaller. Always check their credit rating (AA or above) before investing more than ₹5 lakh. Compare rates on SBI portal

🧠 8. How to Choose the Right FD in 2025

✅ Check the Bank’s Credit Rating (CRISIL, ICRA)

✅ Compare FD rates for multiple tenures

✅ Check for premature withdrawal penalty

✅ Prefer online FDs for instant tracking & easy renewal

✅ Use cumulative FD for higher compounding returns

📅 FD Rates by Tenure (Short, Medium & Long Term)

🔸 Best Fixed Deposit Rates in India 2025 Short-Term (7 days – 1 year)

Ideal for parking idle cash.

- Yes Bank – 7.60%

- RBL Bank – 7.75%

- AU SFB – 8.25%

🔸Best Fixed Deposit Rates in India 2025 Medium-Term (1–3 years)

Perfect for moderate goals.

- Canara Bank – 7.25%

- Equitas SFB – 8.50%

- Ujjivan SFB – 8.75%

🔸Best Fixed Deposit Rates in India 2025 Long-Term (3–10 years)

Best for stable growth & senior citizens.

- PNB – 7.80%

- IDFC FIRST – 7.90%

- RBL Bank – 8.00%

🧓 Special FDs for Senior Citizens (2025)

Senior citizens (60+ years) usually get an additional 0.50% interest rate.

Senior citizens enjoy 0.50% extra on regular rates.

Some banks even launch exclusive senior plans like:

| Bank | Scheme Name | Interest Rate | Tenure |

|---|---|---|---|

| SBI | SBI Wecare Deposit | 7.50% | 5 years |

| HDFC Bank | Senior Citizen Care FD | 7.75% | 5 years |

| ICICI Bank | Golden Years FD | 7.75% | 5 years |

| RBL Bank | Super Senior Citizen FD | 8.50% | 2–5 years |

Best Fixed Deposit Rates in India 2025 Top Banks for Senior Citizens:

- HDFC Bank Senior Citizen FD – 7.60%

- RBL Bank Senior Citizen FD – 8.50%

- Ujjivan SFB Senior Citizen FD – 9.25%

Also read: Best Credit Cards in India for Cashback 2025

Tip: Use the “Senior Citizen Special FD Scheme” for higher returns and quarterly payout options.

💡 Tip: Senior citizens can select monthly payout for regular income post-retirement.

⚖️ FD vs Mutual Fund vs Savings Account

| Feature | FD | Mutual Fund | Savings Account |

|---|---|---|---|

| Returns | 6.5%–9% | 8%–15% | 3%–4% |

| Risk | None | Moderate–High | None |

| Liquidity | Medium | High | High |

| Taxation | Fully taxable | Capital gains | None |

| Safety | Very Safe | Market-linked | Safe |

Verdict Of Best Fixed Deposit Rates in India 2025 :

- Choose FD for short-term safety.

- Choose Mutual Funds for long-term growth.

- Use both in a 70:30 ratio for balance.

💸 Taxation Rules on FD Interest

- Best Fixed Deposit Rates in India 2025

FD interest is taxable under “Income from Other Sources”. - Banks deduct TDS (Tax Deducted at Source) if interest exceeds ₹40,000 (₹50,000 for senior citizens).

- Submit Form 15G / 15H to avoid TDS if total income < taxable limit.

- Invest in Tax Saver FDs (5 years) for deduction under Section 80C (up to ₹1.5 lakh).

🧾 Example: Best Fixed Deposit Rates in India 2025

If you earn ₹60,000 interest from FDs, TDS = ₹6,000 deducted automatically unless you submit 15G/15H.

🧮 FD Calculator Best Fixed Deposit Rates in India 2025 (Example)

| Amount | Tenure | Interest Rate | Maturity Amount |

|---|---|---|---|

| ₹1,00,000 | 3 years | 7.5% | ₹1,24,340 |

| ₹5,00,000 | 5 years | 8.0% | ₹7,34,663 |

| ₹10,00,000 | 10 years | 7.5% | ₹20,56,000 |

Investment: ₹10,00,000

Rate: 7.5%

Tenure: 10 years

Return: ₹20,56,000

Use an FD calculator to compare various tenures and interest payouts.

🧠 Expert Tips to Maximize FD Returns

- Laddering Strategy: Split your investment into 3 parts (1 yr, 3 yr, 5 yr).

- Compare Rates Regularly: FD rates change quarterly — check before renewal.

- Use Online FD Booking: Apps like Groww, Paytm Money offer better rates.

- Avoid Premature Withdrawals: Penalty = 0.5%–1%.

- Diversify: Use 2–3 banks for safety & better returns.

- Avoid premature withdrawals.

- Opt for quarterly or annual payout to control cash flow.

- Check corporate FDs (like Mahindra Finance, Bajaj Finance) — they offer 8.5–9.2%.

- Reinvest the maturity amount instead of withdrawing.

- Invest during repo rate hikes (higher interest periods).

🔐 Safety Measures (DICGC Insurance)

Every FD is insured up to ₹5 lakh per depositor per bank (principal + interest).

If you have ₹10 lakh, split across two banks for full safety.

Your deposits in all banks are insured up to ₹5 lakh per depositor (principal + interest).

If you have more funds, split across multiple banks to stay protected.

💼 Best Corporate FDs (Non-Banking)

| Company | Interest Rate | Tenure | Credit Rating |

|---|---|---|---|

| Bajaj Finance | 8.60% | 3 years | CRISIL AAA |

| Mahindra Finance | 8.55% | 2–3 years | ICRA AAA |

| Shriram Finance | 8.75% | 3 years | CRISIL AA+ |

| PNB Housing Finance | 8.35% | 5 years | CARE AA |

⚠️ Corporate FDs offer higher returns but slightly higher risk than bank FDs.

🌐 Best Online Platforms to Book FDs

| Platform | Features |

|---|---|

| Groww App | Compare top banks, easy eKYC |

| Paytm Money | Instant FD without account |

| ET Money | Smart maturity tracker |

| Bajaj Finserv App | Auto-renew & monthly payout options |

You can book FDs digitally without visiting a branch:

- Groww App

- Paytm Money

- ET Money

- Bajaj Finserv FD Platform

These platforms allow comparative FD rates, auto-renewal, and instant eKYC setup.

📘 Case Study: FD Laddering Example

Investor: Ramesh, 35 years old

Total Savings: ₹3 lakh

👉 Strategy: Best Fixed Deposit Rates in India 2025

- ₹1 lakh in 1-year FD (Axis Bank – 7.10%)

- ₹1 lakh in 3-year FD (RBL Bank – 8.00%)

- ₹1 lakh in 5-year FD (PNB – 7.80%)

When 1-year FD matures, reinvest at new rates.

This keeps returns growing while maintaining liquidity.

Latest FD updates on MoneyControl

🧾 FAQ – Frequently Asked Questions

Q1: Which bank gives the highest FD rate in 2025?

➡️ Ujjivan Small Finance Bank offers up to 9.25% for senior citizens.

Q2: What is the safest FD in India?

➡️ SBI, HDFC, ICICI are safest with AAA ratings.

Q3: Can I break my FD anytime?

➡️ Yes, but you’ll lose 0.5–1% interest as penalty.

Q4: Which FD gives tax benefit?

➡️ 5-year tax-saving FDs (eligible under Section 80C).

Q5: Can I open FD online?

➡️ Yes, through your bank’s app or investment platforms like Groww.

🏁 Conclusion — Is FD Still Worth It in 2025?

Absolutely ✅

FDs are still one of the safest investments in India, offering steady returns between 7%–9%.

Want to improve your credit profile before FD application?

However, smart investors diversify — using a mix of FDs, SIPs, and debt mutual funds.

If your goal is stability, not speculation, Fixed Deposits are your best ally in 2025.