Need money today? best loan apps in India No time for bank visits and paperwork? Welcome to 2026, where your smartphone is your loan officer.

From emergencies to education, from travel to weddings, instant personal best loan apps in India now provide quick, paperless, and secure borrowing options. But with dozens of apps available, how do you know which ones are safe and RBI-approved?

Read it till the end to know the best RBI-approved instant best loan apps in India, updated with loan ranges, features, and eligibility.

What Are Instant Personal Loan Apps?

Instant personal best loan apps in India are mobile platforms that let you apply for unsecured loans directly from your phone. These loans:

Require Minimum Documents

- Are Mostly Paperless

- Get Approved in Minutes

- Get Disbursed Quickly

best loan apps in India People take instant loans for:

- Medical Emergencies

- Home Repairs

- Travel or Education

- Salary Shortfalls

Top Instant Personal best loan apps in India 2026

Let us see the top instant personal best loan apps in India 2026. These apps are approved by RBI and are for you if you are searching for personal loan instant approval, instant personal loan without income proof, or even instant personal loan without CIBIL score:

| App Name | Interest Rate (p.a.) | Loan Amount | Key Features | Eligibility Criteria |

| Navi | Starting from 9.9% | ₹10,000 – ₹20 lakh | 100% paperless, quick disbursal, flexible EMIs | Salaried/self-employed, age 21–65, CIBIL 650+ |

| KreditBee | 15% – 29.95% | ₹3,000 – ₹4 lakh | Short-term and personal loans, fast approval | Salaried, age 21–60, monthly income ₹10,000+ |

| CASHe | 12% – 30% | ₹7,000 – ₹3 lakh | Salary advance, rewards on timely payments | Salaried professionals, age 20–58, income proof required |

| PaySense | 16% – 36% | ₹5,000 – ₹5 lakh | EMI calculator, easy top-up loans | Salaried/self-employed, age 21–60, CIBIL 650+ |

| MoneyTap | 13% – 24% | ₹3,000 – ₹5 lakh | App-based credit line, instant withdrawal | Salaried/self-employed, age 23–55, stable income |

| Dhani | 13.99% onwards | ₹1,000 – ₹15 lakh | Instant credit, Dhani app discounts | Salaried/self-employed, age 21–60 |

| NIRA | 1.67% per month onwards | ₹5,000 – ₹1 lakh | Loans for salaried with income ₹12,000+ | Salaried, age 21–55, monthly income ≥ ₹12,000 |

| LazyPay | 18% – 25% | ₹10,000 – ₹1 lakh | Pay Later + personal loan option | Salaried/self-employed, age 22–55 |

| Bajaj Finserv | 11% onwards | ₹30,000 – ₹25 lakh | Trusted NBFC, high-value loans | Salaried/self-employed, age 21–60, income proof required |

| HDFC Bank Instant Loan (via app) | 10.5% onwards | ₹50,000 – ₹40 lakh | Instant approval for pre-approved customers | Existing HDFC customers, good credit history, age 21–60 |

More Notable Apps for Instant Personal Loan in 2026

Apart from the table above, there are many other RBI-approved apps in 2026 that offer instant personal loans. The following are some of the other apps:

- True Balance: ₹5,000 – ₹1,25,000, ideal for microloans.

- mPokket: Up to ₹45,000, great for students.

- Hero FinCorp: Up to ₹5,00,000, competitive rates.

- IndiaLends: Up to ₹50,00,000, a loan comparison platform.

- Dhani: ₹1,000 – ₹15,00,000, quick approval.

- Vi Finance: New digital channel within the Vi App offering personal loans and more, courtesy of a partnership with Aditya Birla Capital.

- FatakPay: This new player emphasises financial wellness and also provides instant personal loans with basic KYC.

- Kissht: Instant consumer & personal loans, flexible EMIsStashFin: Growing popularity among millennials for credit line loans

TrueCaller Loans (via True Balance NBFC tie-up): Still active in microloans - FlexSalary: Salary advance-style instant loans

- Olyv: Popular for small-ticket loans to first-time borrowers

You can explore them in detail on the Money Insight Hub website.

Benefits of Instant Personal best loan apps in India

Instant personal loan online: Tap, apply, and get funds in minutes.

- No documents/income proof required: Some apps provide alternative credit scoring for faster approvals.

- No CIBIL score requirement: Apps like Nira, SmartCoin, mPokket, FlexSalary, and EarlySalary can approve based on your digital behaviour.

- Bank apps like Axis Bank, Bank of Baroda, and HDFC Bank still offer instant personal loan products based on your credit score. For example, Axis provides personal loans online, requiring salary slips and bank details.

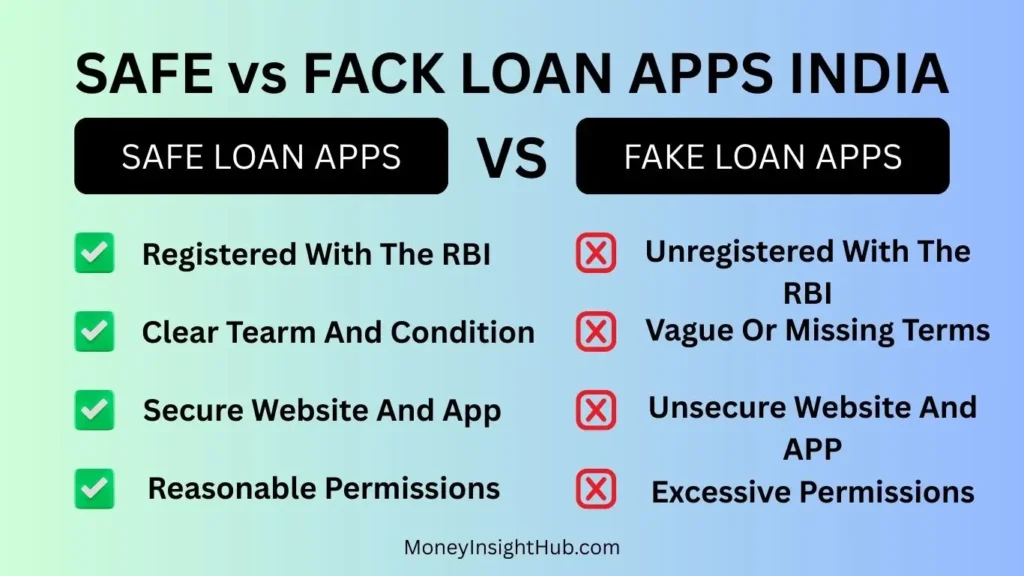

How to Choose a Safe and Reliable Instant Personal Loan App?

Selecting the right app ensures a secure borrowing experience. Consider these factors:

- Verify Physical Address: Check for a legitimate offline address and website.

- Confirm RBI Registration: Ensure the app or its partner is RBI-approved (RBI website).

- Read Reviews: Look for genuine user feedback on platforms like Google Play.

- Check Data Privacy: Understand what personal data is required and how it’s protected.

- Website Security: Look for HTTPS and a lock icon on the lender’s site.

- Special Features: Some apps offer credit score tools or flexible terms.

- Quick Disbursal: Choose apps with fast fund transfers.

- Loan Flexibility: Ensure you can use funds for any purpose.

- Transparent Fees: Watch for hidden charges or conditions.

- Customer Support: Opt for apps with responsive service.

Tips for Safe Borrowing best loan apps in India

To protect yourself:

- Avoid No-Credit-Check Apps: They may charge exorbitant rates.

- Check RBI Status: Use the RBI’s NBFC list to verify legitimacy.

- Read Terms Carefully: Understand interest rates and fees before signing.

- Borrow Only What You Need: Avoid overborrowing to prevent repayment stress.

- Beware of Scams: Stick to well-reviewed apps and avoid sharing sensitive data unnecessarily.

How to Apply for an Instant Personal Loan?

You need to follow the steps mentioned below to apply for an instant personal loan:

- Research Lenders: Compare apps for rates and terms.

- Check Eligibility: Review age, income, and credit requirements.

- Download and Register: Install the app and create an account.

- Complete Application: Submit personal and financial details with KYC documents.

- Choose Loan Details: Select the amount and repayment term.

- Review Terms: Understand rates, fees, and penalties.

- Submit Application: Wait for approval, often within minutes.

- Receive Funds: Funds are typically disbursed within 24 hours.

Conclusion

Instant personal best loan apps in India have simplified borrowing, offering quick solutions for financial needs. By choosing RBI-approved apps and borrowing responsibly, you can manage emergencies or goals effectively. Explore options like for a seamless experience, and always prioritise timely repayments to maintain a healthy credit score.

(FAQs) best loan apps in India

Q1: Are loan apps in India safe or fraud?

A1: Loan apps linked with RBI-registered NBFCs are safe. Avoid unregistered apps that promise instant loans without KYC.

Q2: How to check if a loan app is genuine?

A2: Visit RBI’s official website and verify the NBFC partner’s name. Avoid apps not listed under registered lenders.

Q3: What are instant personal loan apps?

A3: Mobile platforms offering quick, unsecured loans with minimal documentation.

Q4: Are no-credit-check apps safe?

A4: Be cautious; reputable lenders usually check credit, and no-check apps may have high rates.

Q5: Can I use multiple loan apps?

A5: Not recommended, as managing multiple repayments can strain finances.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.