credit card vs debit card, also known as charge cards, may sound unfamiliar to many, but they are essentially the familiar “VISA debit card.” Issued by a bank when you open an account, debit cards offer both credit card vs debit card functionality. Some also integrate with electronic ticketing, allowing you to use them for public transportation or small payments. Functionally, they are almost identical to credit card vs debit card, and some even offer

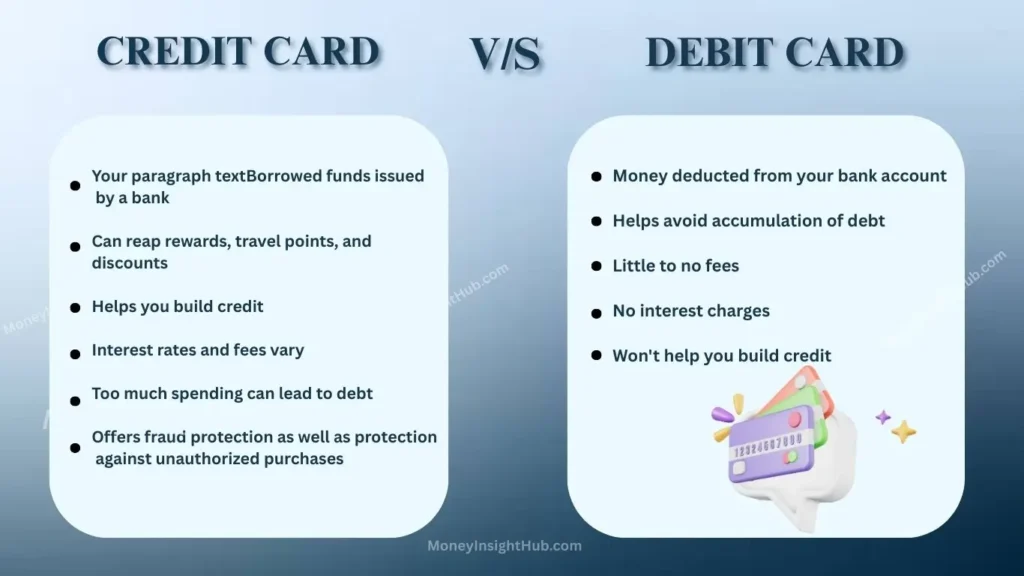

cash back making them a top choice for students, budget-conscious individuals, or those who find it difficult to obtain credit cards. However, the application requirements and payment methods for debit cards differ from those of credit cards, and you might even miss out on rewards due to different payment methods. What are the differences between debit cards and credit cards? Money Insight Hub

will analyze and compare the differences, advantages, and disadvantages of both below. You can also refer to this article,

A Comprehensive Summary of Cash Back Rewards for Debit Cards from Banks .

What is a debit card?

A debit card is a type of debit card linked to a bank account for payments. It can be considered a debit card with swiping functionality; funds must be deposited into the account beforehand (the account must have sufficient funds). The transaction amount is directly deducted from the linked account, thus avoiding overdraft or overspending issues. Debit cards can also be used to withdraw cash from ATMs. Unlike credit card vs debit card offer different credit limits and installment payment options. The card also provides a 16-digit code, the same as a credit card, for making purchases. Besides entering the card number, debit cards can also be swiped via contactless payment or chip reader.

What are the differences between a credit card vs debit card ?

Differences in functionality and credit limit

First, a debit card is like a cash withdrawal card for your account. In addition to withdrawing cash from your account, you can also use it like a regular credit card to make purchases at physical stores and online e-commerce platforms. Debit cards do not have a credit limit, and the spending limit is equal to the amount in your account. “Spend as much as you have,” allowing people who want to control their spending to avoid maxing out their cards and having debt problems.

Credit card limits depend on your personal credit score and proof of financial resources. You can also apply to the bank to adjust your limit. Credit limits come from your account. Debit cards do not allow for “deferred payment” or “installment payment” because the amount is deducted from your account immediately. To spend a large sum, you must ensure that there are sufficient funds in your account.

Different application requirements

To apply for a credit card, you must be at least 18 years old, have a stable income, and provide proof of funds and a joint credit report. The processing time is relatively long, as banks prioritize the applicant’s repayment ability and personal credit. The application requirements are stricter, requiring credit checks. Poor credit, outstanding debts, being self-employed, or having a business may result in disqualification. credit card vs debit card, on the other hand, can be applied for by those at least 15 years old. If you are under 18 and have not opened an account, you need parental consent and must bring your ID to the application process.

Different risks of credit card vs debit card fraud

If your credit card is lost or fraudulently used, you can report it to the bank immediately. The fraudulently used amount can be listed as a disputed amount. Many banks also provide instant notifications for card transactions, allowing cardholders to detect problems immediately. Debit cards have relatively lower instant notification and no-payment risk protection compared to credit cards. Only a few banks clearly state that there is zero risk of fraud or lost cards, as well as the card notification function. This may result in the funds not being recovered. If you have any doubts, it is recommended that you call the bank to inquire and clarify.

credit card vs debit card rewards and discounts are different

Credit cards often offer various benefits, such as cash back, bonus points, mileage accrual, or merchant partnerships. While debit cards don’t have as many rewards or partnerships as credit cards, some debit cards do offer cash back or other benefits, so keep an eye out for them!

| credit card vs debit card | ||

| project | Credit Card | Debit Card |

| Credit limit | Banks make decisions based on proof of financial resources and individual credit. | Account deposit amount |

| Annual fee | Yes, certain conditions must be met to waive the annual fee. | none |

| installment | have | none |

| Delayed payment | have | none |

| Revolving interest rate | have | none |

| Credit card spending rewards (cash rebates, points accumulation, etc.) | have | uncertain |

| Other additional benefits | International cardholder organization discounts , travel insurance, inconvenience insurance , airport transfers, lounge access, city parking discounts , cash advances, and other channel partnership discounts. | International card issuer benefits, spending at participating international card issuer stores, travel insurance, inconvenience insurance (varies by issuer, please refer to bank announcements). |

| Application Requirements | Must be at least 18 years old , have stable income and stable employment, possess both required certificates, and provide proof of financial resources through joint credit investigation. | The minimum age requirement is 15 years old and having a bank account (some banks accept minors under 15 with parental consent). Those without an account must bring both identification documents. Those under 18 years old need parental consent to open an account. |

| advantage | Deferred payments, installment payments , lost cards, and fraudulent transactions are mostly covered by the bank, offering numerous benefits and adjustable credit limits. | Deposits equal credit card spending limits, allowing control over the amount spent. Application requirements are relatively low, and some offer rewards. |

| shortcoming | The application requirements are high, and there is a risk of revolving interest if payments are not made on time. | The risk of lost cards and fraudulent transactions is high, and funds may be unrecoverable. Transactions without installment or deferred payment options may result in funds being locked up. |

Debit cards & digital account recommendations

While most debit card offers can’t match the benefits of credit cards, there are still many “digital account + debit card” combinations that offer consumers exceptionally high deposit interest rates, spending rewards, or merchant discounts. These digital account offers are great deals that tech-savvy young professionals shouldn’t miss, with debit cards even offering up to 18% spending rewards! Let’s

take a look at some of these great digital accounts and debit cards

credit card vs debit card use different payment methods, so be careful not to miss out on cash rewards when using them!

credit card vs debit card debits are simpler and clearer, and the details of the rewards are listed in the terms and conditions. If it is a debit card with rewards, the reward restrictions and spending items are the same as those of a credit card vs debit card However, combine the functions of a chip card and a credit card, so there are two ways to make a purchase: one is “debit for purchase” using the chip card, and the other is “debit for purchase” using the credit card. Debit for purchase does not qualify for rewards!

Debit cards involve inserting the chip from your debit card into a machine and entering your personal PIN; the amount is then deducted from your account. Debit cards typically display the logos of international card issuers such as VISA, JCB, and Mastercard, and can be used at participating merchants. The process is similar to using a regular credit card: scanning a barcode or using a contactless payment system, followed by the cardholder’s signature, and the amount is deducted from your account. If you have a debit card with a reward program, remember to ensure the debit function is enabled during the application process; otherwise, you won’t be able to use it like a credit card or earn reward benefits.

Frequently Asked Questions about credit card vs debit card

Q1. Is a credit card vs debit card?

A debit card is not a credit card. Unlike a credit card, which borrows money from a bank through credit to make purchases and then pays the card fee later, a debit card is a debit card, where you use the balance in your own bank account to make purchases.

Q2. What is a debit card?

Simply put, a debit card is a debit card with card-swiping functionality, but it differs from a credit card in terms of credit limit and installment payment options.

Q2. What is the difference between a credit card vs debit card?

The main difference is that debit cards do not have a credit limit; when you swipe the card, a certain amount is directly deducted from your account before the final payment is made. Additionally, debit cards cannot be used for installment payments.

Q3. What is the difference between a VISA credit card vs debit card?

A VISA debit card is a type of debit card issued by VISA credit card vs debit card.

Q4. What are the advantages and disadvantages of debit cards?

The biggest advantage of debit cards is that the deposit amount equals the credit limit, so you can control the amount of money you spend. They also have a low application threshold and some debit cards offer spending rewards. The disadvantages are that there is a high risk of the card being lost and stolen, making it difficult to recover the money. They also do not have installment or deferred payment options, and you need to deposit funds into your account first.

Q5. How long does it take for a refund from a debit card to be credited to my account?

The refund process for debit cards typically takes 5 to 9 business days, depending on the card reader and the bank. Generally, it takes no more than 7 to 10 business days for the refund to be credited to your account.

[…] Here is a list of India’s Best CashBack Credit Card in India 2026 to carry in your wallet –Credit Card vs Debit Card – Which is Better? […]