How to Improve CIBIL Score Fast If there is one thing that all financial experts unanimously recommend, it is to have a high credit score as this can open multiple doors for you financially. Not only will you avail credit easily, you can also get them at lower interest rates and other advantageous terms.

Your credit score plays a significant role in determining whether or not you will be approved for a loan. It is calculated using your credit history, which includes previous credit taken and payment patterns associated with it.

Low credit scores mark you as a high-risk borrower, and lenders will be hesitant to approve your loan application.

Today, all Banks and NBFCs mandatorily verify the CIBIL score of borrowers. But even if you have a low credit score, the good news is that there are ways to improve the same.

Let us first understand what a good CIBIL score is and then find out you can improve your score easily.

What is a ‘Good’ Credit Score?

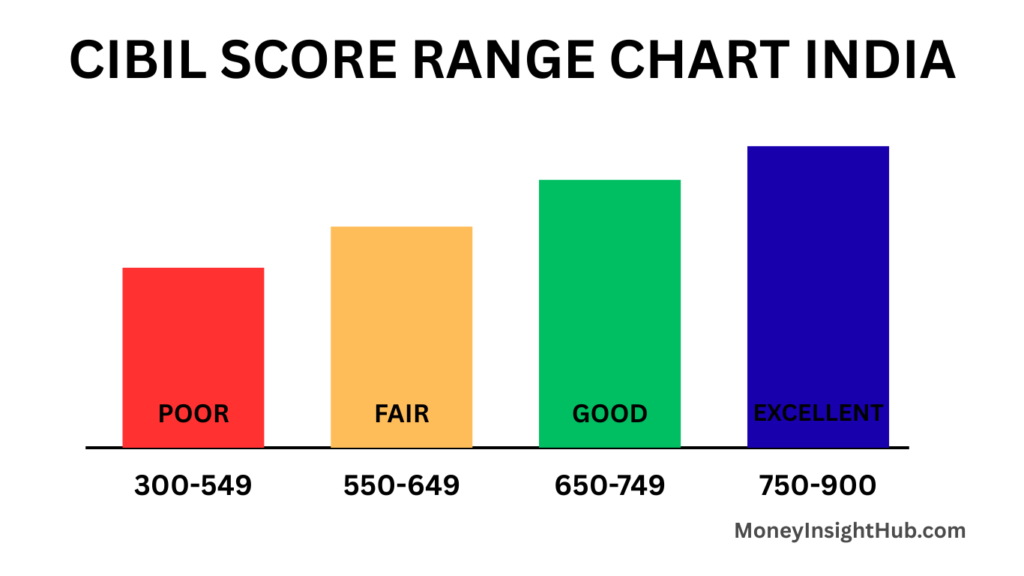

TransUnion CIBIL, one of India’s largest and most popular credit bureaus, assigns credit scores ranging from 300 to 900 to individuals and businesses and the higher the score, the better it is.

The closer your score is to 900, the more likely it is that your loan will be approved. A score of 300 to 549 is considered poor, while a score of 550 to 700 is considered fair. A score above 750 is considered to be excellent.

Here’s why your CIBIL score matters and How to Improve CIBIL Score Fast

- It influences loan approvals

- It determines the interest rate you’ll be charged

- It affects the credit limit on your credit cards

- It reflects your financial discipline

For salaried individuals and first-time credit users, knowing How to Improve CIBIL Score Fast can make all the difference when applying for personal, car, or home loans.

What Is Considered a Good CIBIL Score?

- 750-900: Excellent – High chance of loan approval

- 700-749: Good – Eligible for most loans

- 650-699: Fair – May get loan but with higher interest rates

- 300-649: Poor – Loan likely to be rejected

If your score falls in the lower range, don’t panic. You can rebuild it over time with consistent effort.

CIBIL Score Range and Credit Health

Let us understand what a certain score range means for your creditworthiness.

| Credit Score Range | Creditworthiness Indicator |

|---|---|

| 300-549 | Inadequate CIBIL scoreUnusual repayment patternsPayment failuresCredit risk is highHigh risk of becoming a defaulter |

| 550-649 | A decent CIBIL score but needs improvementPayment of credit card bills/EMIs after the due dateSeveral credit inquiries |

| 650-749 | Good CIBIL scoreResponsible repayment practices and a lengthy credit history.Eligible for a loan and a credit cardYou may have to pay a higher interest rateThere is a low risk of becoming a defaulter |

| 750-900 | Exceptional CIBIL scoreThere have been no missed paymentsNo outstanding feesResponsible credit managementLower interest ratesHigh bargaining powerA good credit history |

Reasons for Low CIBIL Score

Before diving into How to Improve CIBIL Score Fast, let’s understand what brings it down:

- Missed or delayed EMI or credit card payments

- High credit utilization ratio (more than 30%)

- Having multiple unsecured loans

- Errors in your credit report

- Applying for multiple loans or credit cards at once

- Defaulting on loans

Understanding the reasons for a low CIBIL score is the first step in fixing it.

Steps to Improve CIBIL/Credit Score

If your score is low, here are some steps that you can take to help improve the same –

- Examine Your Credit Report – How to Improve CIBIL Score Fast

Checking your credit reports on a regular basis is a good idea as you can find out about all the defaulted or delayed payments that have reduced your credit score.

Additionally, you can also correct mistakes if there are any by visiting the official website, www.cibil.com. You must act on the disputes within 30 days and make the necessary corrections.

- Monitor Your Credit Utilisation Ratio – How to Improve CIBIL Score Fast

It is essential to maintain a credit utilisation ratio of 30% or less. You will see an improvement in your CIBIL score if you do this. Use your credit card judiciously and do not use it to withdraw cash or purchase items that you don’t need.

- Do Not Reapply Immediately After Rejection of Credit Application – How to Improve CIBIL Score Fast

If you apply for a loan or a credit card and your application is denied, the information will appear on your credit report. While this will not directly affect your credit score, if you continue to apply, your score will get negatively impacted.

- Do not apply for Credit Frequently – How to Improve CIBIL Score Fast

You should avoid applying for loans and credit cards too frequently. Each time you apply for credit, the bank will request your credit report from CIBIL, and the inquiry will be recorded in the report. If these inquiries are frequent, your credit score will be impacted as you will be seen as credit-hungry.

- Make On-time Payments on Your Credit Cards – How to Improve CIBIL Score Fast

When it comes to credit cards, the best thing to do is to avoid exceeding the credit card’s limit. You should also ensure that you are not only paying just the minimum amount due on your credit cards, but that you are paying the entire amount or at least a sizable amount.

- Borrow the Minimum Amount – How to Improve CIBIL Score Fast

If you apply for too many loans or are constantly nearing the limit on your credit card, your score is likely to suffer because such activities demonstrate credit-hungry behaviour.

The best thing to do is to avoid taking out loans unless absolutely necessary, and to avoid exceeding your credit card limits.

- Set Payment Reminders – How to Improve CIBIL Score Fast

Your ability to repay debts can have a significant impact on your credit score. This is why you must exercise self-control when it comes to EMI payments.

Delays in EMI payments not only result in a penalty, but also decrease your credit score. So, make it a point to set EMI payment reminders so that you can complete them on time.

- Utilize Types of Credit – How to Improve CIBIL Score Fast

If you haven’t borrowed money in the past, you won’t have a credit history, and your CIBIL score will be nil as a result. So, to build a strong credit score or improve your existing credit score, borrow a healthy mix of credit, both secured and unsecured.

Tips to How to Improve CIBIL Score Fast (Long-Term)

If you’re looking for sustainable ways on How to Improve CIBIL Score Fast, consider these expert tips:

Tip 1: Pay All EMIs and Credit Card Bills on Time

Set reminders or automate payments to never miss a due date.

Tip 2: Maintain a Healthy Mix of Credit

A balanced mix of secured (home/car loan) and unsecured (personal loan/credit card) credit shows that you can handle different types of loans responsibly.

Tip 3: Increase Your Credit Limit (But Use It Wisely)

Increasing your limit lowers your utilization ratio. Don’t use the extra credit; just keep it as a buffer.

Tip 4: Keep Old Credit Accounts Open

A long credit history helps improve your score. Don’t close old, active accounts unless necessary.

Tip 5: Monitor Joint Accounts and Co-Signed Loans

Missed payments in joint accounts or loans co-signed with someone else also affect your score.

Tip 6: Use Secured Credit Cards

If you’re rebuilding your score, opt for a secured credit card backed by a fixed deposit. It’s easier to get approved and helps rebuild your credit profile.

How to Improve CIBIL Score Fast After Default

Loan defaults can significantly damage your credit history. Here’s How to Improve CIBIL Score Fast after default:

- Repay the default amount in full or negotiate a settlement

- Obtain a No Dues Certificate from the lender

- Follow it up with timely payments on other active loans

- Use a secured credit product (like Credit Saison’s secured card)

- Wait and maintain consistency – your score will improve over time

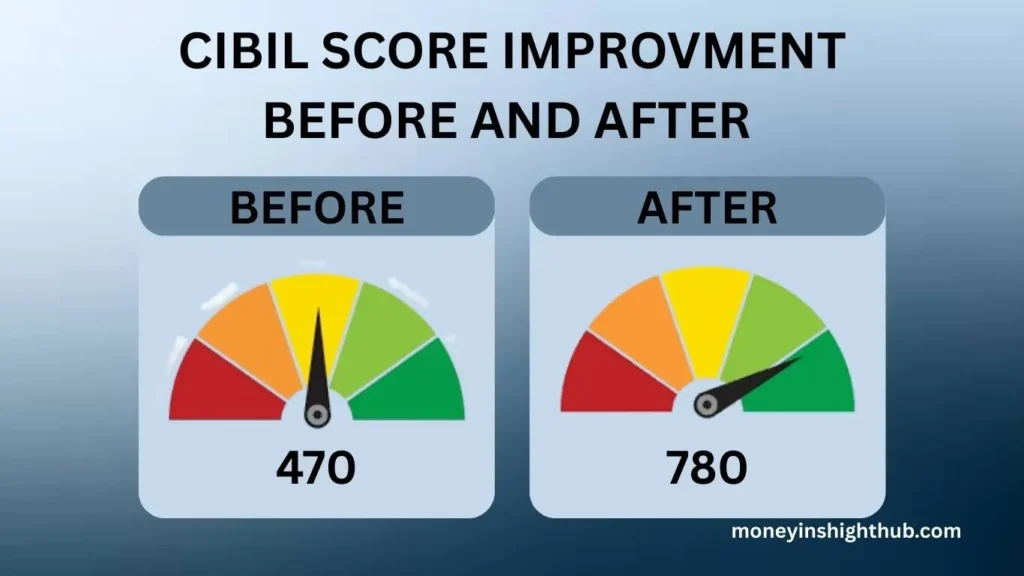

How Long to Improve CIBIL Score?

Many users ask: how long does it take to increase CIBIL score?

The timeline depends on the damage:

- Minor delays or high utilization: 1–3 months

- Loan defaults or settlement: 6–12 months

- No credit history: 3–6 months of active usage

Credit Score vs CIBIL Score – What’s the Difference?

Credit score is a general term, while CIBIL score is India’s most widely recognized version. Other credit bureaus in India include Experian, Equifax, and CRIF Highmark. However, most lenders rely on your CIBIL score for loan approvals.

How to Check CIBIL Score Online?

You can check your score online in these ways:

- Visit the official CIBIL website and create a login

- Use the Credit Saison India platform

- Access via partner banks or fintech apps

Checking your CIBIL score regularly helps you track progress and take timely action.

Credit Card Impact on CIBIL Score

Your credit card behavior greatly influences your CIBIL score:

- Late payments hurt your score

- Maxing out cards increases your utilization

- Regular, full payments improve your profile

- Avoid applying for too many cards at once

FAQs – How to Improve CIBIL Score Fast

Q: Why is my CIBIL score low even after timely payments?

A: Factors like high credit usage, too many inquiries, or errors in your credit report may be responsible.

Q: Does paying credit card bills early improve CIBIL?

A: Yes, it reduces your credit utilization ratio and reflects responsible credit use.

Q: Can I get a loan with low CIBIL score?

A: It’s difficult but not impossible. NBFCs and fintechs like Credit Saison India consider income and transaction history, not just the score.

Q: Does requesting a higher credit limit improve the score?

A: Yes, having a higher credit limit reduces your credit utilisation ratio, which improves your score. However, you must utilise the additional credit responsibly.

Q: Is it necessary to have multiple credit cards to reach 900?

A: No, you do not need numerous credit cards to achieve a credit score of 900; your ability to manage and repay your existing credit is what is important in determining your credit score.

[…] Let us see the top instant personal best loan apps in India 2026. These apps are approved by RBI and are for you if you are searching for personal loan instant approval, instant personal loan without income proof, or even instant personal loan without CIBIL score: […]

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

[…] you can even build a healthy credit score by opting for student loans and paying them off […]